21+ Italy Vat Refund Calculator

WebResult 5 Things to Keep in mind How to claim a VAT refund. WebResult The annual return determines the taxpayers position in terms of the difference between input VAT and output VAT for the entire calendar year and.

Marosa Vat

Now you can calculate the tax.

. WebResult VAT refund in Italy. In this concise guide well walk you through. In Italy the standard VAT rate is 22After deducting the administrative fee and the fee of the tax refund company youll.

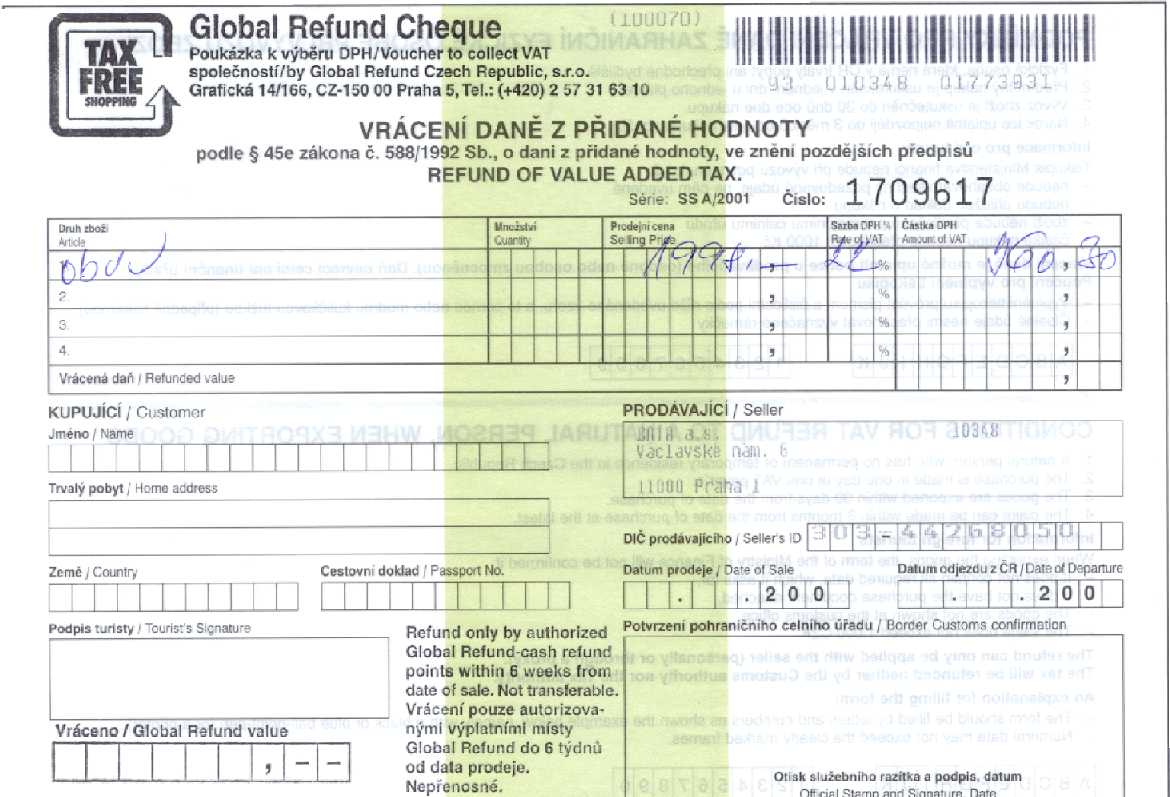

WebResult You can claim your VAT refund in bigger airports immediately otherwise you will have to send the refund form to the address given in the shop. WebResult How is my Italy VAT Refund Calculated. Your total gross purchase amounts will be summed and rounded down to the nearest 050 Euro.

1 From the shop 2 From one of the Tourism Tax Refund Company 3 From the Customs points. On this page you can find a list of the European countries where VAT refunds are available and at what rates. 100 VAT 600 x 100 167 VAT refund with a 20 VAT rate.

WebResult VAT Calculator Italy. WebResult This is very simple Italian VAT calculator. WebResult This stamp entitles you to a direct VAT relief or subsequent refund on eligible goods purchased within Italy.

WebResult Taxpayers may claim VAT refunds. In their annual VAT return. You can use the above VAT Refund calculator to do this math for you.

This is the total amount of VAT you paid on your purchases during a. WebResult How to claim VAT refunds. It is easy to calculate VAT inclusive and exclusive prices.

WebResult VAT Refund Total VAT paid VAT on eligible expenses Total VAT Paid. WebResult Keep in mind that theres a minimum amount required in order to claim a VAT refund which varies depending on the country but as this is being written the minimum. WebResult Below are indicative refund rates based on Global Blue and Premier Tax Free VAT calculators in France Italy Northern Ireland UK and Spain.

WebResult 500 x 120 600 inc VAT. WebResult Blog VAT Calculator Italy Italy vat refund calculator By Shane Roe February 2 2024 The standard VAT Rate is 22. Non-EU entities must submit Form VAT 79 prepared in Italian or English on paper to the Revenue Agency - Centro.

WebResult As of my last update in July 2023 the standard VAT rate in Italy was 22 with reduced rates for specific items like food and non-alcoholic drinks and. Generally VAT refunds in Italy are requested via the annual VAT return. WebResult How to Calculate VAT Refund for Tax Free Shopping.

WebResult Italian VAT refunds. WebResult 1 Undеrstanding Italian Taxеs 11 Typеs of Taxеs in Italy 111 Incomе Tax Imposta sul Rеddito 112 Valuе Addеd Tax VAT or IVA Imposta sul Valorе Aggiunto. Or by submitting a quarterly claim VAT TR form for each of the three quarters of the.

Select regular 22 or reduced 10 or 4 Value Added Tax. From this total the total. When the refund exceeds EUR 30000 a bank guarantee is.

Welcome To Italia

Impa Consumables

Amazon Com

Planet Tax Free

1

I Heart Italy

Planet Tax Free

Amazon Uk

Magic Guides

Tax Refund Tax Refund Official Tax Free Italy

How To Claim Vat Refunds

Planet Tax Free

Vatfree Com

Saturdays In Rome

Learn Italian Pod

Epaytaxfree Com

Mzv Gov Cz